👋 Happy Saturday! This weekend’s highlights include a report on the landscape of aerial drone delivery, a chart mapping global investments in semiconductor manufacturing, and musings about the ideal hardware testing stack.

Interesting Report: The Future of Aerial Drone Delivery

From a 2024 PwC report on global drone deliveries: the global B2C drone delivery market is expected to grow from 5 million deliveries to 808 million deliveries (that’s ~$65B worth of goods!) over the next decade. The reason is simple: automation drives down costs, and drones can be more energy-efficient.

Their advantage depends on the setting. In dense urban areas, ground vehicles win because they can handle multiple deliveries in a single trip, making better use of time and fuel. In rural areas, where long distances and limited infrastructure make traditional last-mile delivery inefficient, drones provide a significant advantage.

The full report is worth a read, exploring standard drone platform architectures, network configurations (point-to-point vs. centralized), and the challenges of integrating them into retail and logistics operations.

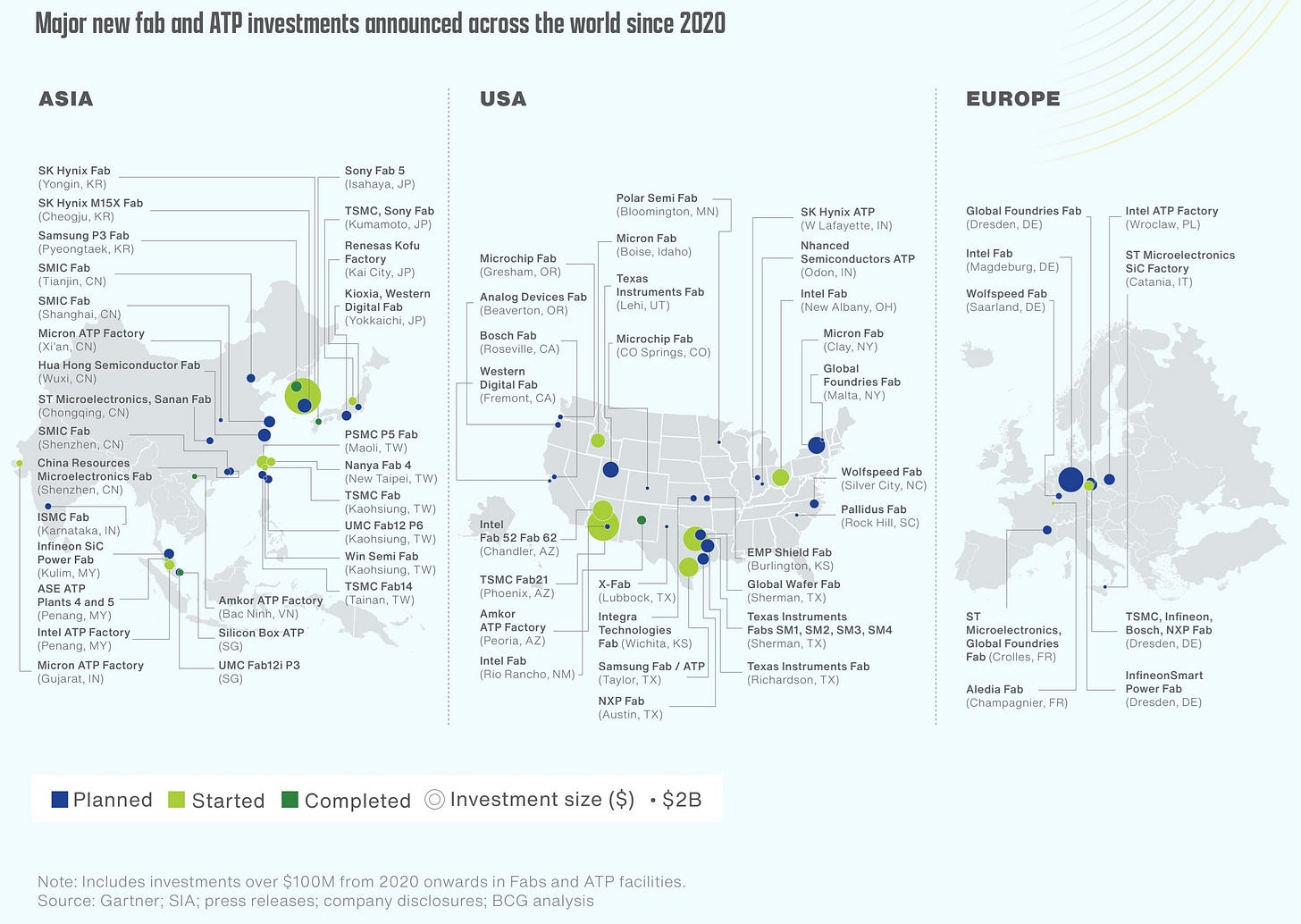

Interesting Chart: Global Semiconductor Manufacturing Investments

The US is expected to triple its semiconductor manufacturing capacity by 2032, driven mainly by the CHIPS and Science Act. This surge, backed by nearly $450 billion in private investments and federal incentives, aims to boost the US share of global advanced logic manufacturing to 28%. Without CHIPS funding, that number would be just 8%. Europe, meanwhile, is taking a more cautious approach under its own CHIPS Act, focusing on reinforcing its existing semiconductor base rather than rapid expansion.

Asia still dominates, with Taiwan alone projected to account for 31% of global semiconductor capital expenditure through 2032, driven by its own incentives. China, meanwhile, is ramping up with the third phase of its IC Industry Investment Fund, though its state-backed approach raises concerns about supply chain fairness.

Refer a Friend, Get a T-Shirt! 👕

If you like the newsletter, chances are you know a few others who would too. Refer five of them, and we’ll send you a t-shirt. No strings attached. Just a simple thank you.

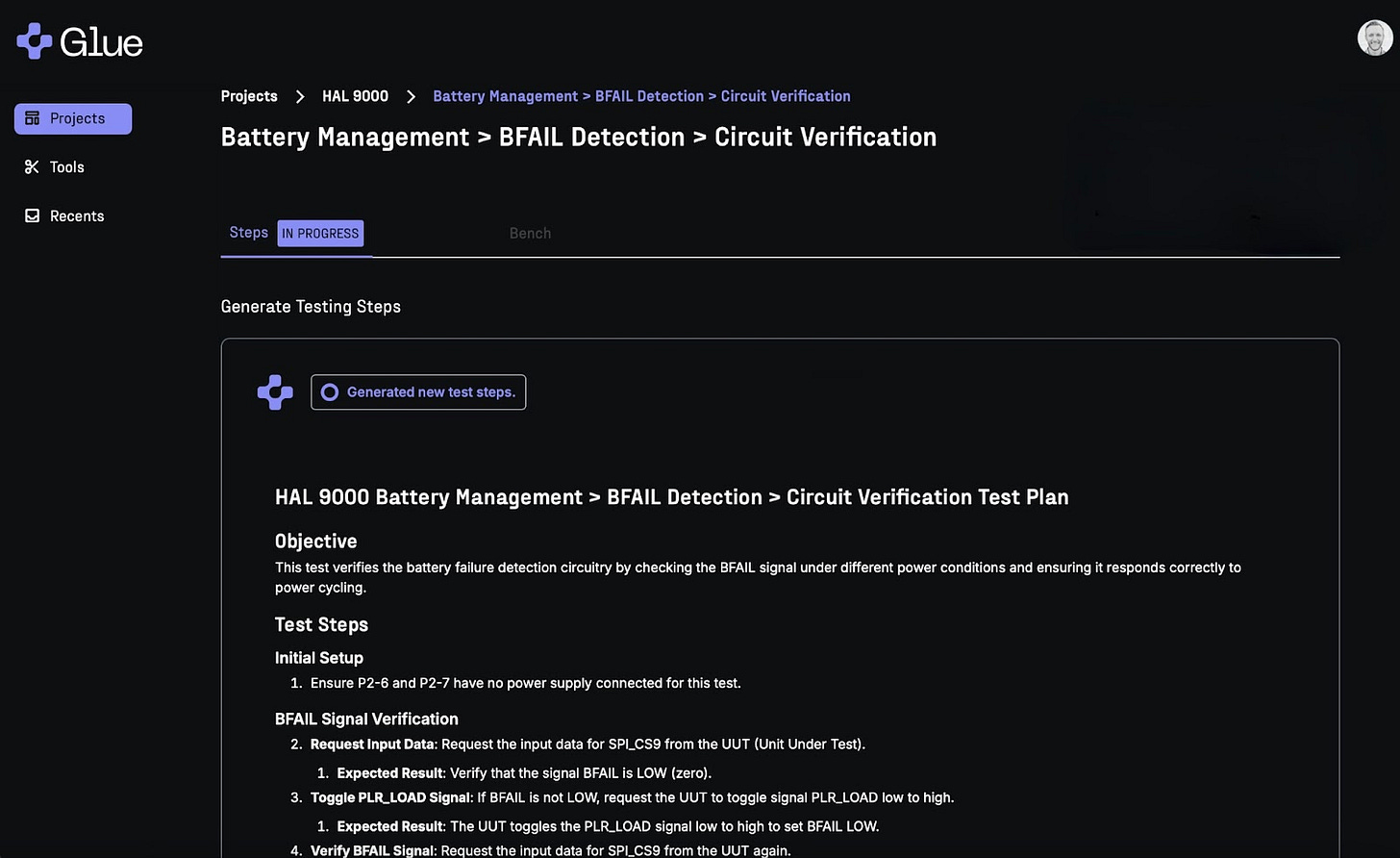

Musings About The Ideal Hardware Testing Stack

I’ve used a lot of hardware testing instruments: for power testing, I like Keysight’s N6705C for programmable DC power and Chroma’s 63206A for DC loads—both excellent, but running on entirely different automation frameworks. Keithley’s DMM6500 or 7510 are my go-to for power analysis and debugging, and while Keithley also makes solid alternatives to Keysight and Chroma, swapping instruments just for better software integration isn’t always practical.

For signal generation and analysis, the Tektronix 6 Series B MSO is my favorite, with the MS05 as a solid all-purpose backup. Tek also makes the best time domain reflectometer in my view. And for quick checks, I always keep a Fluke multimeter and a FLIR thermal camera on hand.

In the end, my bench has about seven instruments from four or five vendors—best-in-class choices, but not built to work seamlessly together.

We recently sat down with David Sulpy, a serial founder who started by bootstrapping his first company and now leads new ventures in test and measurement. He's currently building Glue to tackle a familiar challenge: the fragmented world of hardware testing. The above is a snippet of his ideal hardware testing stack. Read the full interview here!

Manufacturing & Startup News

More leftovers from our weekly research in hardware and manufacturing news:

Europe’s largest battery project is now live. Located in Blackhillock, Scotland, the project is backed by $130.5M in debt financing secured by Zenobē.

Canada invested $212.3M to develop next-generation Canadian deuterium uranium (CANDU) nuclear reactors for clean energy.

Watter raised $5M in seed funding to repurpose waste heat from computing devices to heat water in buildings.

Aptera completed its first validation testing phase for its solar electric vehicle.

Dutch startup QuantWare raised a $21.8M Series A to accelerate quantum computing development.

Tandem PV raised $50M in debt financing to lead U.S. perovskite solar manufacturing.

Thanks for reading to the end - if you’ve enjoyed the mechanics of these insights, consider sharing this issue with a fellow enthusiast!